In the rapidly growing world of cryptocurrency, one of the most important tools you need to navigate this new digital frontier is a crypto wallet MetaMask. Whether you are a seasoned trader or a newcomer to the cryptocurrency space, understanding how these wallets work is essential for securing your assets and interacting with the blockchain ecosystem.

What is a Crypto Wallet?

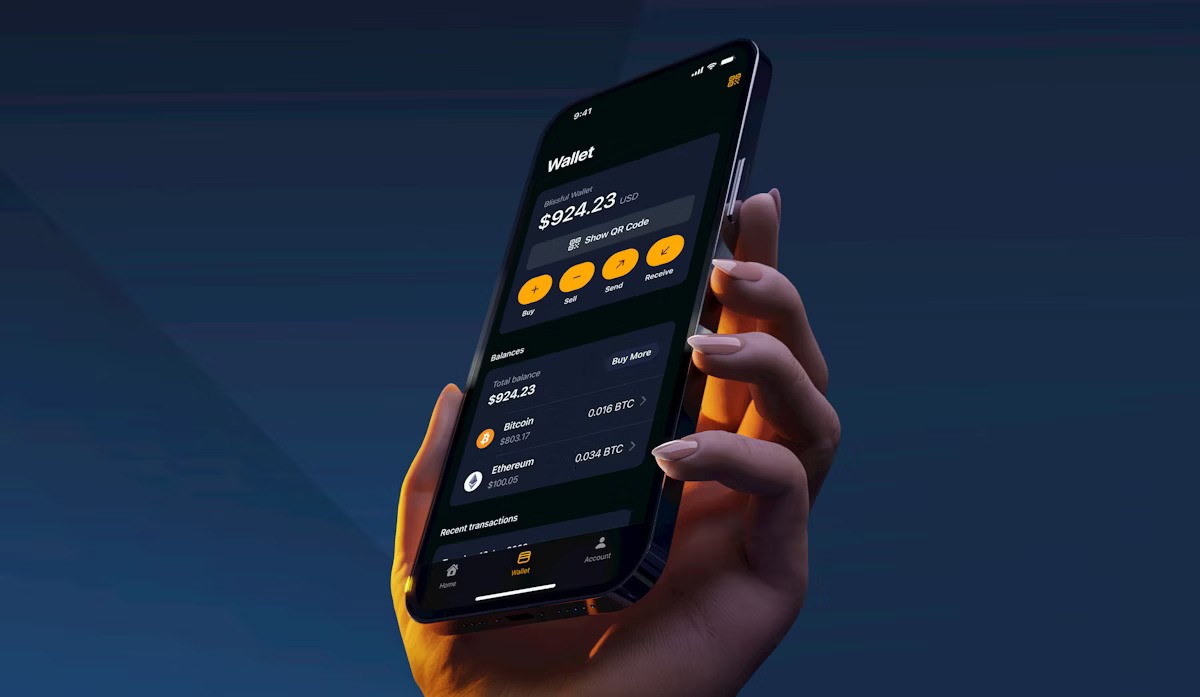

A crypto wallet is a software or hardware-based tool that allows you to store, send, and receive cryptocurrency securely. Think of it as a digital wallet, similar to the wallet you carry in your pocket, but instead of cash and cards, it holds digital assets like Bitcoin, Ethereum, or any other cryptocurrency.

However, unlike a traditional wallet, crypto wallets don’t actually store the cryptocurrency themselves. Instead, they store the private keys that are used to access and manage your cryptocurrencies on the blockchain. The private key is essentially a secret code that proves ownership of the digital coins in your account, while the public key acts as an address where others can send you cryptocurrency.

Types of Crypto Wallets

There are two primary categories of crypto wallets: hot wallets and cold wallets.

- Hot Wallets:

- Definition: These wallets are connected to the internet and are accessible via apps or web platforms.

- Examples: Coinbase Wallet, MetaMask, Trust Wallet.

- Pros:

- Convenient for frequent transactions as they are always online.

- Easy to access and use for trading or moving coins.

- Cons:

- Being connected to the internet means they are more susceptible to hacking or malware attacks.

- Less secure than cold wallets for long-term storage.

- Cold Wallets:

- Definition: Cold wallets are offline wallets used for storing cryptocurrency in a more secure manner.

- Examples: Hardware wallets like Ledger, Trezor, and paper wallets.

- Pros:

- Extremely secure since they are not connected to the internet, making them less prone to online attacks.

- Ideal for long-term storage of large amounts of cryptocurrency.

- Cons:

- Not as convenient for frequent transactions, as they require physical interaction with the device.

- Losing your cold wallet or its backup phrase could mean losing access to your funds permanently.

How Do Crypto Wallets Work?

Crypto wallets work by generating a pair of cryptographic keys: a public key and a private key.

- Public Key: This key is shared with others, allowing them to send cryptocurrency to your wallet. It’s like your bank account number.

- Private Key: This key is never shared with anyone. It is used to sign transactions, proving ownership of the cryptocurrency stored in the wallet. Think of it as your bank password or PIN.

When you send cryptocurrency, you sign the transaction with your private key, which gets broadcast to the network and validated by others in the blockchain system. The blockchain ledger then records the transaction, and the new balance is reflected in your wallet.

Choosing the Right Crypto Wallet

The choice of a crypto wallet depends largely on your needs, such as frequency of transactions, amount of cryptocurrency held, and your desire for security.

- For Frequent Traders: Hot wallets, due to their convenience and ease of use, are often preferred by active traders. They allow for quick transactions and seamless integration with cryptocurrency exchanges.

- For Long-Term Investors: Cold wallets are better suited for investors who plan to hold onto their assets for the long term. Their enhanced security features ensure that digital currencies are protected from online threats.

How to Keep Your Crypto Wallet Safe?

While crypto wallets are a great tool for managing your assets, they also come with their own set of security challenges. Here are a few tips to keep your wallet safe:

- Backup Your Keys: Always make sure you back up your private keys in a secure location. This could be a hardware device or a written record kept in a safe place. Losing your private key could mean losing access to your crypto forever.

- Enable Two-Factor Authentication: Many hot wallets provide two-factor authentication (2FA) to add an extra layer of security. This requires a secondary authentication code (like one from an app) in addition to your password.

- Use Strong Passwords: Whether for your wallet app or exchanges, using strong, unique passwords is crucial. Avoid common phrases or easily guessed combinations.

- Update Regularly: Always keep your software wallet or app updated to the latest version. This helps protect you against vulnerabilities and security flaws.

- Be Cautious of Phishing Attacks: Avoid clicking on suspicious links or downloading unknown software. Always verify the source before sharing sensitive information.

Conclusion

Crypto wallets are indispensable for anyone involved in the cryptocurrency world. Whether you’re sending a few coins to a friend or holding your assets for long-term investment, your wallet serves as the gateway to managing your digital wealth. By understanding the different types of wallets, how they work, and how to keep them secure, you can navigate the crypto world with greater confidence and safety.